Central Bank of India acquires Future Enterprise Limited’s 25.18% stake in Future Generali India Life Insurance, marking a strategic move to strengthen its presence in the insurance sector.

Central Bank of India acquires Future Enterprise Limited’s 25.18% stake in Future Generali India Life Insurance, marking a strategic move to strengthen its presence in the insurance sector.

Why Choose Generali Central Money Back Super Plan?

Because life’s big moments deserve more than just hope they need a plan.

Whether you’re saving for your child’s milestones, planning a family celebration, or simply looking for peace of mind, the Generali Central Money Back Super Plan helps you stay prepared.

You get guaranteed payouts at regular intervals to support your goals, along with life cover that ensures your efforts don’t go in vain. So, if something happens to you, your loved ones still receive the financial support they need. It’s a simple, dependable way to save and secure your future.

Guaranteed Benefits

On death, survival, and maturity

Money back Payouts

Receive fixed payouts at regular intervals

Flexible Plan Options

Choose based on financial goals

Survival Benefits

Get survival benefits during the term, based on the category you choose.

Guaranteed Additions

Yearly bonuses start from the 8th policy year

Tax Benefits

Enjoy tax savings as per current tax laws

Step-by-Step Guide to Secure Your Future

Get Expert Advice from Your Trusted Life Insurance Partner!

Need quick answers? Count on Generali Central Life Insurance Partner for expert guidance and reliable support for all your life insurance needs.

Tailored Plan Options to Secure Your Future

Choose the plan that fits your life

Option 1

Offers steady returns and life cover with an affordable premium, ideal when you want protection without stretching your budget.

Min: Entry Age 0 years to 50 years: Rs. 90,000/-

Entry Age 51 years to 55 years: Rs. 3,00,000/-

Max: As per Board approved underwriting policy However, Death Benefit shall not exceed the maximum as defined in the POS regulations, circulars and clarifications thereof, as prescribed by the IRDAI from time to time. The Current limit is Rs. 25,00,000 (as on 1st Jan 2021).

Platinum: 6

Gold: 8

Silver: 10

Where ‘Annualized Premium’ excludes the applicable taxes, rider premiums and underwriting extra premiums, if any.

Option 2

Helps you get more out of your plan with higher returns and enhanced survival benefits, perfect when you're aiming for bigger milestones.

Min: Entry Age 0 years to 50 years: Rs. 71,250/-

Entry Age 51 years to 55 years: Rs. 2,37,500/-

Max: As per Board approved underwriting policy However, Death Benefit shall not exceed the maximum as defined in the POS regulations, circulars and clarifications thereof, as prescribed by the IRDAI from time to time. The Current limit is Rs. 25,00,000 (as on 1st Jan 2021).

Platinum: 4.75

Gold: 6

Silver: 6

Where ‘Annualized Premium’ excludes the applicable taxes, rider premiums and underwriting extra premiums, if any.

Offered Across All Plans

Offered Across All Plans

0- 50 Years

18 - 65 years

10/12/15/20 years depending upon Category as below

Regular Pay

10/12/15/20 years depending upon Category as below

Yearly, Half Yearly, Quarterly and Monthly

Minimum:

Age: 0 days-50 years

₹1,325

Age: 51 - 62 years

₹4,415

Maximum: As per Maximum Sum Assured

1. For minors, the date of issuance of Policy and Date of Commencement of risk shall be the same.

2. Premiums mentioned above are excluding the applicable taxes, rider premiums and underwriting extra premiums, if any.

3. Age wherever mentioned is age as on last birthday.

Benefits Under This Plan

Here’s what we offer with this life insurance plan –

As per the chosen category and option you will get Survival Benefits during the policy term, provided all due premiums till date of survival payout are paid and upon survival on the payment due dates which will help you to meet your planned financial milestones. The different categories are:

- Platinum: Get Survival Benefit every year from the end of 6th year till the end of (Policy term minus 1) years.

- Gold: Get Survival Benefit every year from the end of 8th year till the end of (Policy term minus 1) years.

- Silver: Get Survival Benefit every year from the end of 10th year till the end of (Policy Term minus 1) years.

Survival benefits will be a percentage of Sum Assured as described below:

Survival Benefit as a % of Sum Assured

Option 1

Option 2

The payment of Survival Benefit is subject to deduction of any outstanding dues from the Policyholder including but not limited to outstanding Policy loan, loan interest or any other dues and applicable taxes, if any.

- The Policy offers simple guaranteed additions for each completed policy year, starting from the end of 8th Policy year till the end of the policy term, subject to payment of all due premiums.

- Guaranteed additions accrue as a percentage of Sum Assured at the end of applicable policy year.

- The Guaranteed Addition rates are based on the age at entry of the life assured, the option chosen, the category chosen, policy term and annualized premium (excluding the applicable taxes, rider premiums, loadings for modal premium and underwriting extra premiums, if any).

- If a policy is converted into a paid-up policy, it will not accrue any future guaranteed additions. The guaranteed additions already accrued, if any, remain attached to the policy.

- On your survival till the end of the policy term, provided all due premiums have been paid, you will receive Guaranteed Maturity Benefit which is

- Sum Assured on Maturity plus accrued guaranteed additions Where Sum Assured on Maturity is equal to Sum Assured.

- Sum Assured is defined as a multiple of Annualized Premium (excluding the taxes, rider premiums, loadings for modal premium and underwriting extra premiums, if any) depending on the Option and Category chosen.

The multiple for each Category is as below:

Survival Benefit as a % of Sum Assured

Option 1

Option 2

Policy will terminate on payment of maturity benefit.

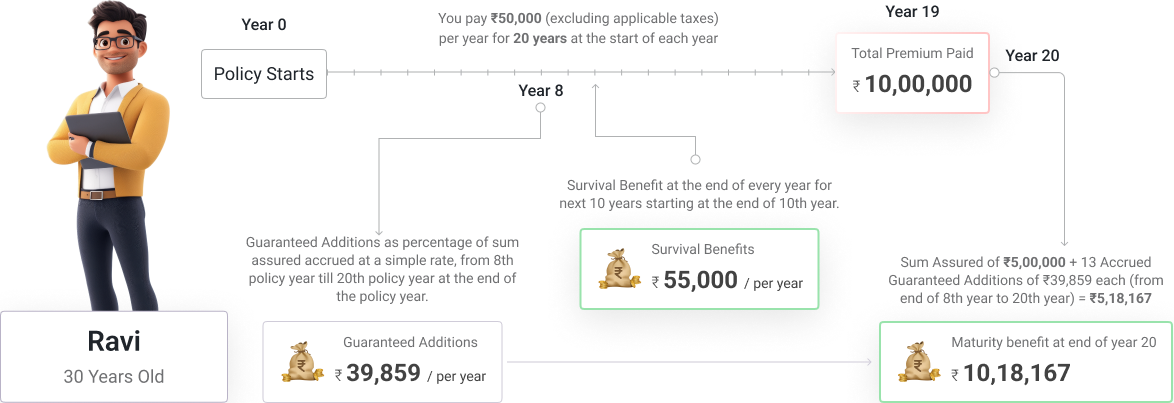

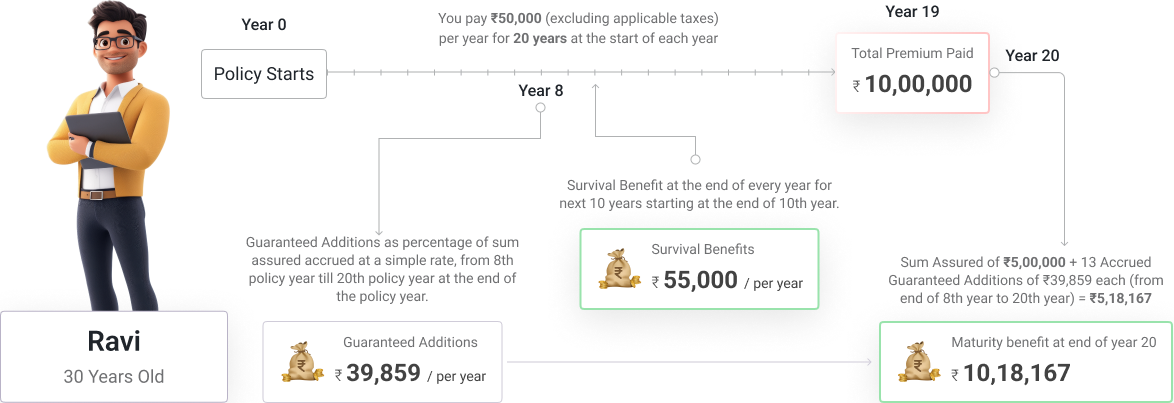

Ravi’s Example

Ravi, a 30-year-old healthy individual, purchases Generali Central Money Back Super Plan

Scenario 1: He has opted for Super Saver Essential Plan - Silver category

Ravi is 30 years old healthy man and has purchased the Generali Central Money Back Super Plan – Option 1. He has opted for Silver category with an annualized premium (excluding the applicable taxes, rider premiums, loadings for modal premium and underwriting extra premiums, if any) of Rs. 50,000. His policy term and premium payment term is 20 years and his Sum Assured on Maturity is Rs. 5,00,000.

He will get survival benefit of Rs. 55,000 every year starting from end of 10th policy year till end of 19th policy year plus guaranteed addition of Rs. 39,859every year will also get accrued in his policy for each completed policy year, starting from end of 8th policy year till end of 20th policy year. The accrued guaranteed additions will be paid along with Sum Assured on Maturity on the policy maturity date as explained below:

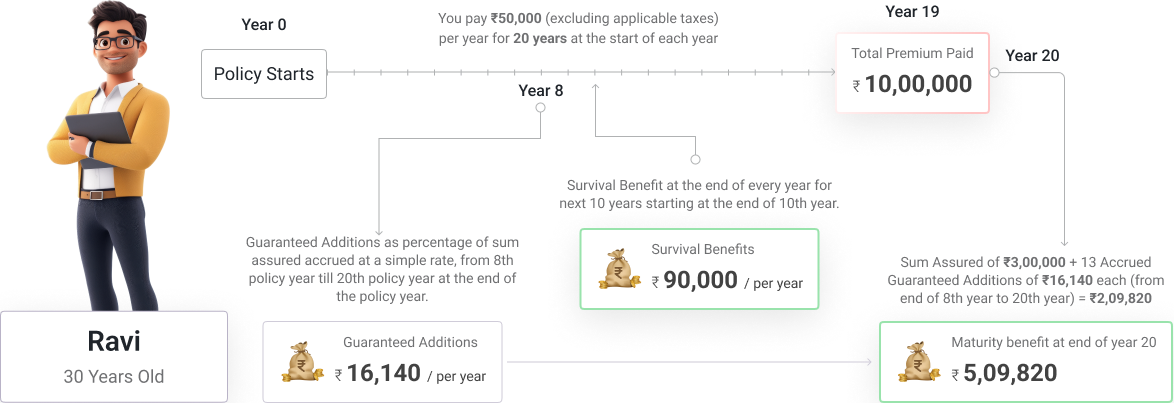

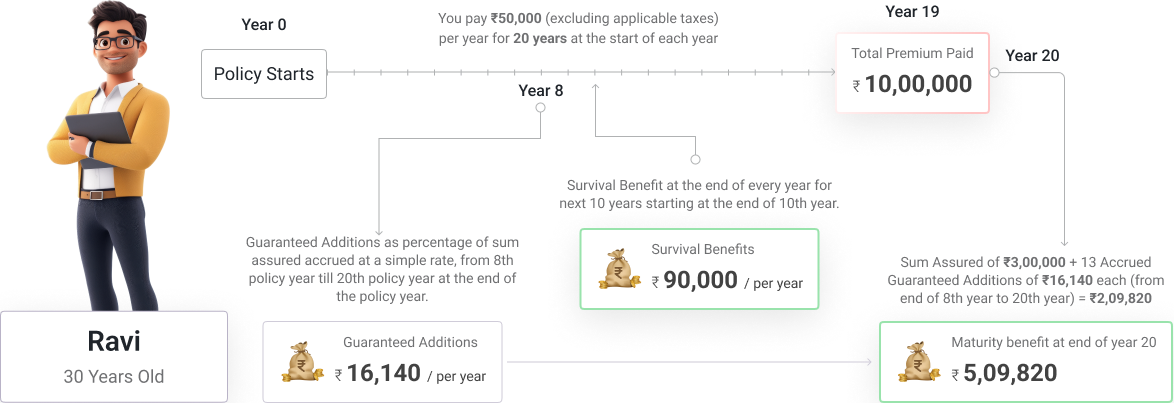

Scenario 2: He has opted for Super Saver Plus Plan - Silver category

Keeping other conditions same, in case Ravi opts for Option 2, his Sum Assured will be Rs. 3,00,000. He will get survival benefit of Rs. 90,000 every year starting from end of 10th policy year till end of 19th policy year plus guaranteed addition of Rs. 16,140 every year will also get accrued in his policy for each completed policy year, starting from end of 8th policy year till end of 20th policy year. The accrued guaranteed additions will be paid along with Sum Assured on Maturity on the policy maturity date as explained below:

Let’s understand the benefits under all options and categories for a 30 year old healthy individual who opts for a 15 year Policy Term, and pays an annual premium of Rs. 50,000 per year.

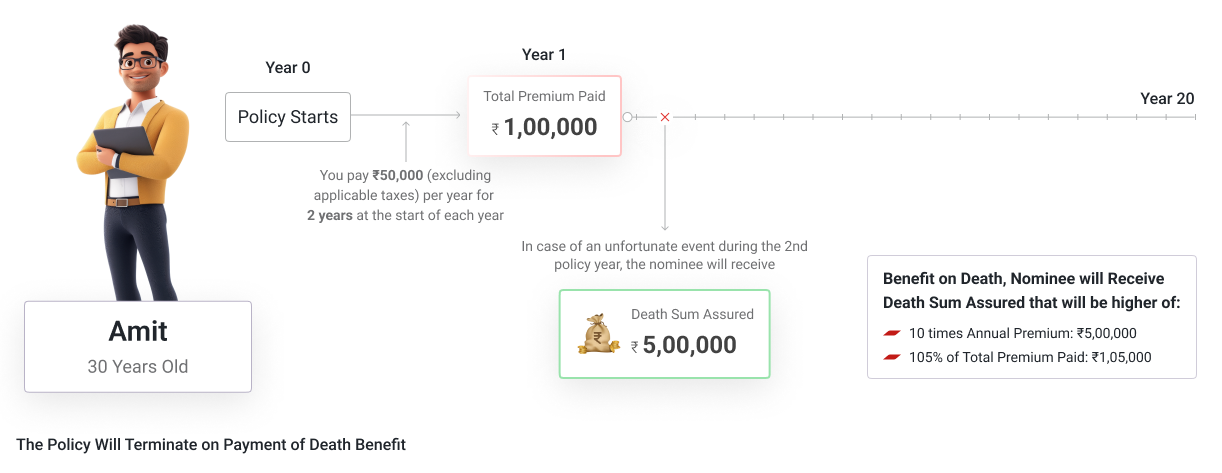

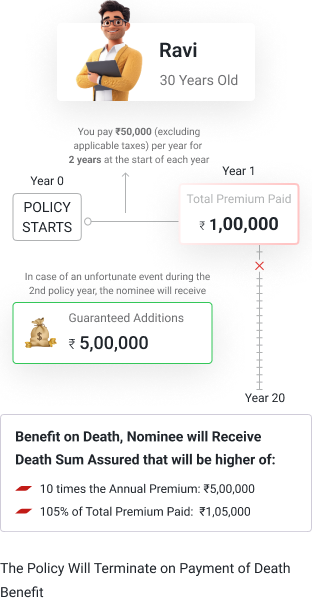

In case of unfortunate demise of the life assured, the death benefit in this plan secures life assured’s family’s financial wellbeing and future. If the policy is in-force and due premium till the date of death have been paid,

The death benefit under all Options and all Categories shall be higher of:

- 105% of total premiums paid as on date of death (excluding the applicable taxes, rider premiums and extra premiums, if collected explicitly) or

- Sum Assured on Death i.e. 10 times of annualized premium (excluding the applicable taxes, rider premiums and underwriting extra premiums, if any) plus Accrued Guaranteed Additions, if any.

Where, Sum Assured on Death is defined as Death Benefit Multiple * Annualized Premium (excluding the applicable taxes, rider premiums and underwriting extra premiums,

if any).

The Death Benefit Multiple available for POS Variant is 10.

Waiting Period

There is a 90 days waiting period from the date of acceptance of risk, within which, if death occurs (other than due to accident), the nominee will receive 100% of the premiums paid till the date of death excluding applicable taxes. During this period, the Sum Assured on Death will not be payable.

In case of death of the Life Assured due to accident, no Waiting Period shall apply and Death Benefit as defined above shall be payable.

The policy will terminate on payment of Death Benefit.

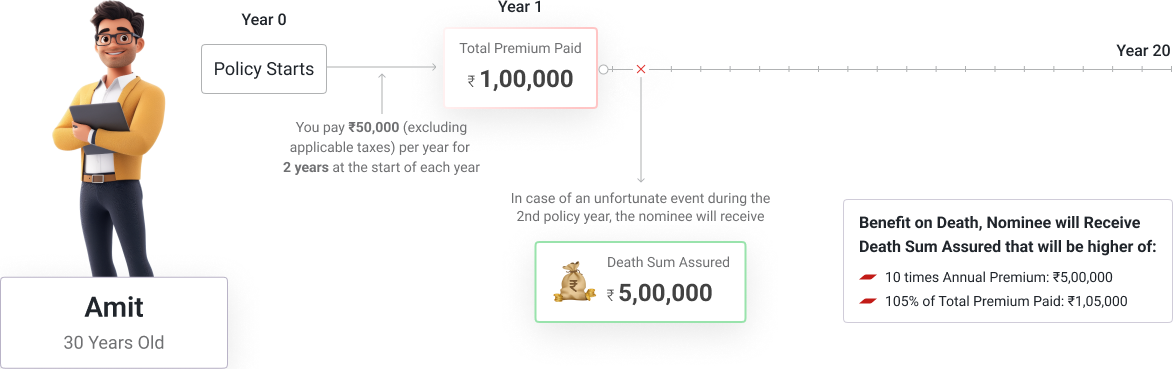

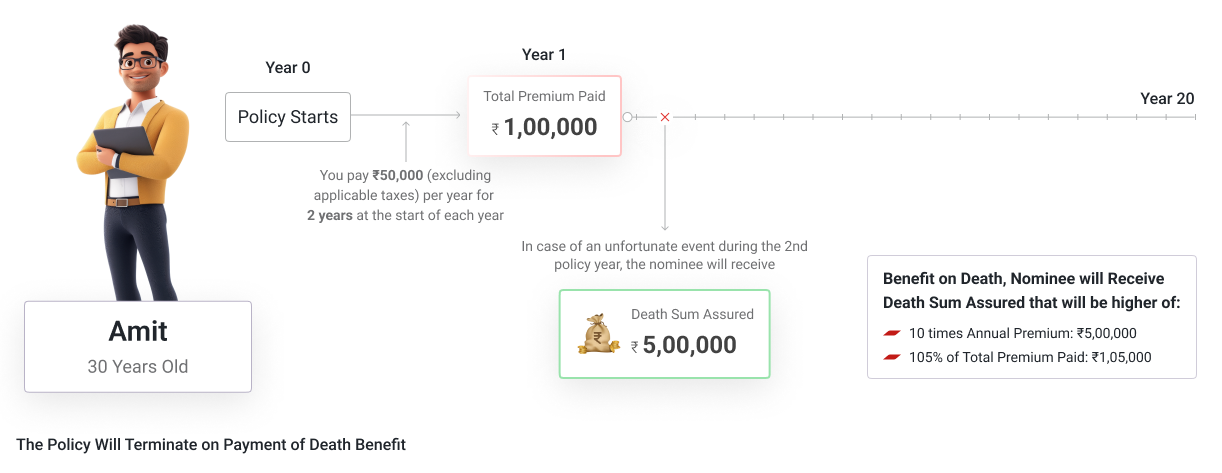

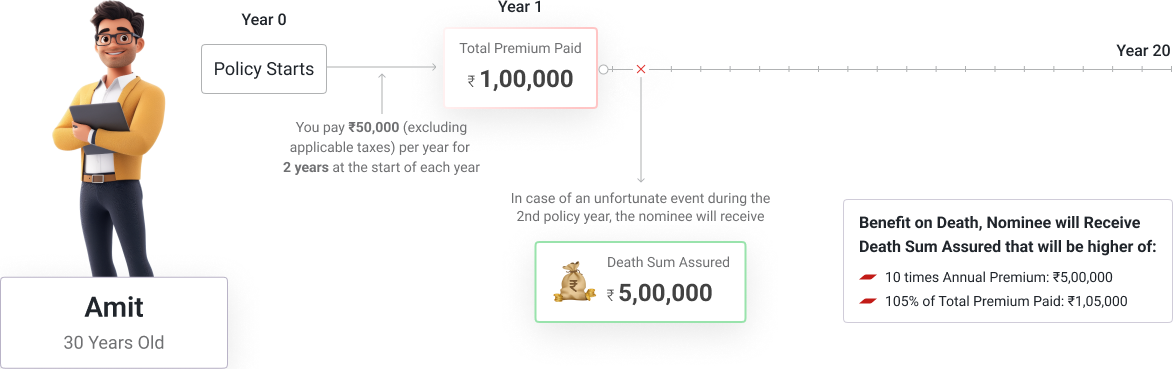

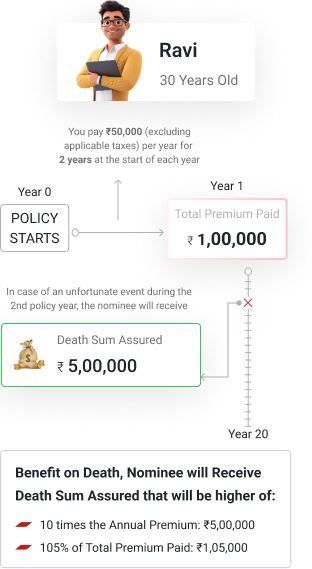

Ravi’s Example

Ravi, a 30-year-old healthy individual, purchases Generali Central Money Back Super Plan

Scenario 1: He has opted for Super Saver Essential Plan - Silver category

Ravi is 30 years old healthy man and has purchased the Generali Central Money Back Super Plan – Option 1. He has opted for Silver category with an annualized premium (excluding the applicable taxes, rider premiums, loadings for modal premium and underwriting extra premiums, if any) of Rs. 50,000. His policy term and premium payment term is 20 years and his Sum Assured on Maturity is Rs. 5,00,000.

It is assumed that Ravi’s death occurs at the end of 2nd policy year. The benefit payable under Option 1 to Ravi's nominee(s) will be:

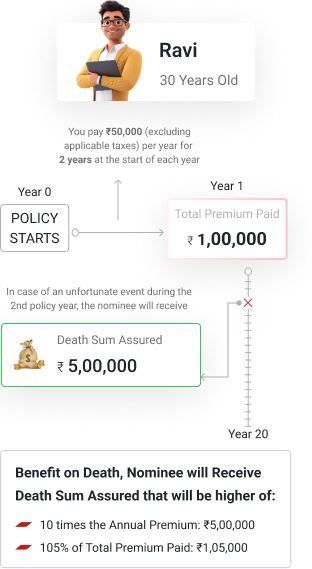

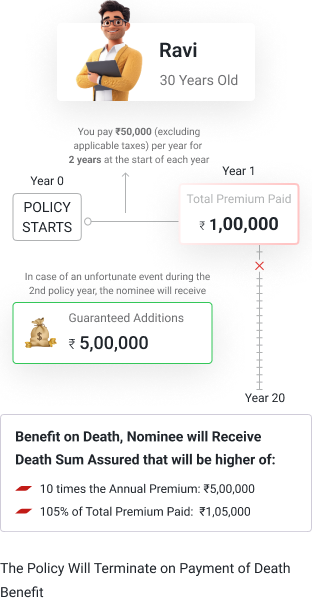

Scenario 2: He has opted for Super Saver Plus Plan - Silver category

Similarly in case Ravi opts for Option 2, his Sum Assured will be Rs. 3,00,000. It is assumed that Ravi’s death occurs at the end of 2nd policy year. The benefit payable under Option 2 to Ravi's nominee(s) will be:

Our Promise is Reflected in the Lives We've Touched

We bring experience, stability and a proven approach to supporting your family and financial goals.

1369

1369Branches across India

897,635

897,635Lives Protected from Day One

₹87.84 Bn

₹87.84 Bnof Assets Under Management

98.08%

98.08%Individual Claim Settlement Ratio

99.78%

99.78%Group Claim Settlement Ratio

Data as on 31st March, 2025

Downloads

Everything you need to understand your policy, plan your future, and make informed decisions at your convenience.

Important Information & Resources

Understand your policy better with key details and insights into our Money Back Super Plan (Pos Variant)

Free Look Period

If you disagree with the terms and conditions of the Policy, you can return the Policy within 30 days of receipt of the Policy Document (whether received electronically or otherwise). To cancel the Policy, you can send us a request for cancellation along with the reason for cancellation. We will cancel this Policy if you have not made any claims and refund the Instalment Premium received after deducting proportionate risk Premium for the period on cover, stamp duty charges, and expenses incurred by us on the medical examination of the Life Assured (if any).

Free Look Period Computation for Insurance Repository (IR)

If the policy is opted through Insurance Repository (IR), the computation of the said Free Look Period will be as stated below:

For existing e-Insurance Account:

- Computation of the said Free Look Period will commence from the date of delivery of the e-mail confirming the credit of the Insurance policy by the IR.

For New e-Insurance Account:

- If an application for e-Insurance Account accompanies the proposal for insurance, the date of receipt of the ‘welcome kit’ from the IR with the credentials to log on to the insurance Account (eIA) or the delivery date of the email confirming the grant of access to the eIA or the delivery date of the email confirming the credit of the Insurance policy by the IR to the eIA, whichever is later, shall be reckoned for the purpose of computation of the Free Look Period.

Non Payment of Due Premium

Lapse:

- If due premium for the first (1) policy year has not been paid in full within the grace period, the policy shall lapse and will have no value.

- All risk cover ceases while the policy is in lapsed status.

- The policyholder has the option to revive the policy within five years from the due date of first unpaid premium.

- In case the Policy is not revived during the revival period, no benefit shall be payable at the end of revival period and the policy stands terminated.

Paid-Up Value:

- If due premiums for the first (1) or more policy years have been paid in full and any subsequent premium is not paid within the grace period, the policy will be converted into a paid-up policy.

- If a policy is converted into a paid-up policy, it will not accrue any future guaranteed additions under both options. The guaranteed additions already accrued, if any, remain attached to the policy.

- If policy is converted into a paid-up policy, future survival benefit payments shall stop and no further survival benefits shall be payable.

Suicide exclusion:

In case of death of Life Assured due to suicide within 12 months from the date of commencement of risk under the policy or from the date of revival of the policy, as applicable, the nominee or beneficiary of the policyholder shall be entitled to at least 80% of the total premiums paid till the date of death or the surrender value available as on the date of death whichever is higher, provided the policy is in force.

Waiting Period:

There is a 90 days waiting period from the date of acceptance of risk, within which, if death occurs (other than due to accident), the nominee will receive 100% of the premiums paid till the date of death excluding applicable taxes. During this period, the Sum Assured on Death will not be payable.

In case of death of the Life Assured due to accident, no Waiting Period shall apply and Death Benefit shall be payable.

Grievance Redressal Processes

In case you have any grievances on the solicitation process, the product sold, or any of the policy servicing matters, you may approach the company in one of the following ways:

- Calling the Customer helpline number 1800-102-2355 for assistance and guidance

- Emailing at care@generalicentral.in

Generali Central Life Insurance Company Limited offers an extensive range of life insurance products, and a distribution network which ensures that we are close to you wherever you go.

At the heart of our ambition is the promise to be a life-time partner to our customers. And with the help of technology we are making the shift from not only offering protection to our customers but also providing personalized services to them.

It starts with our extensive agent base who is at the core of this transformation. Through our distribution network we ensure that there is always a caring touch while servicing the individual needs of our customers. With this philosophy, we aim to make simplicity, innovation, empathy and care synonymous with our brand - Generali Central Life Insurance Company Limited.

Generali Central Money Back Super Plan (UIN : 133N088V05)

This is POS variant of ‘Generali Central Money Back Super Plan’. To avail this product without waiting period and/or for a higher Sum Assured on Death, please opt for NON-POS variant i.e. ‘Generali Central Money Back Super Plan’. Please refer to the NON-POS variant product brochure for more details.

This Product is not available for online sale. Life Coverage is included in this Product

For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the policy document or consult your advisor before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. You are advised to consult your tax consultant. Central Bank of India’s and Generali Group’s liability is restricted to the extent of their shareholding in Generali Central Life Insurance Company Limited. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentrallife.com. For further details please access the link: https://www.generalicentrallife.com/customer-service/grievance-redressal-procedure

What Our Happy Customers Are Saying

Real stories, real people - hear from those who’ve taken the step towards securing their future with us.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

It’s a life insurance plan that gives you money back at regular intervals and also offers life cover. You pay for a few years, and in return, you get payouts during the policy term, plus a lump sum at the end.

Anyone between 18 and 55, can buy this plan easily. Medical tests aren't usually needed but may be required as per underwriting rules.

With the Generali Central Money Back Super Plan (POS Variant), you only need to pay premiums for 10, 12, 15, or 20 years, depending on the plan option you choose. After that, you still stay covered and keep receiving the benefits until the policy ends.

- Get guaranteed money back at set intervals.

- Enjoy life insurance coverage throughout the policy term.

- Earn guaranteed additions from the 8th policy year onwards.

- Receive the sum assured + guaranteed additions at maturity.