Central Bank of India acquires Future Enterprise Limited’s 25.18% stake in Future Generali India Life Insurance, marking a strategic move to strengthen its presence in the insurance sector.

Central Bank of India acquires Future Enterprise Limited’s 25.18% stake in Future Generali India Life Insurance, marking a strategic move to strengthen its presence in the insurance sector.

Have a life goal in mind? Let Generali Central Life Insurance help you plan it right.

Our Promise is Reflected in the Lives We've Touched

We bring experience, stability and a proven approach to supporting your family and financial goals.

1369

1369Branches across India

897,635

897,635Lives Protected from Day One

₹87.84 Bn

₹87.84 Bnof Assets Under Management

98.08%

98.08%Individual Claim Settlement Ratio

99.78%

99.78%Group Claim Settlement Ratio

Data as on 31st March, 2025

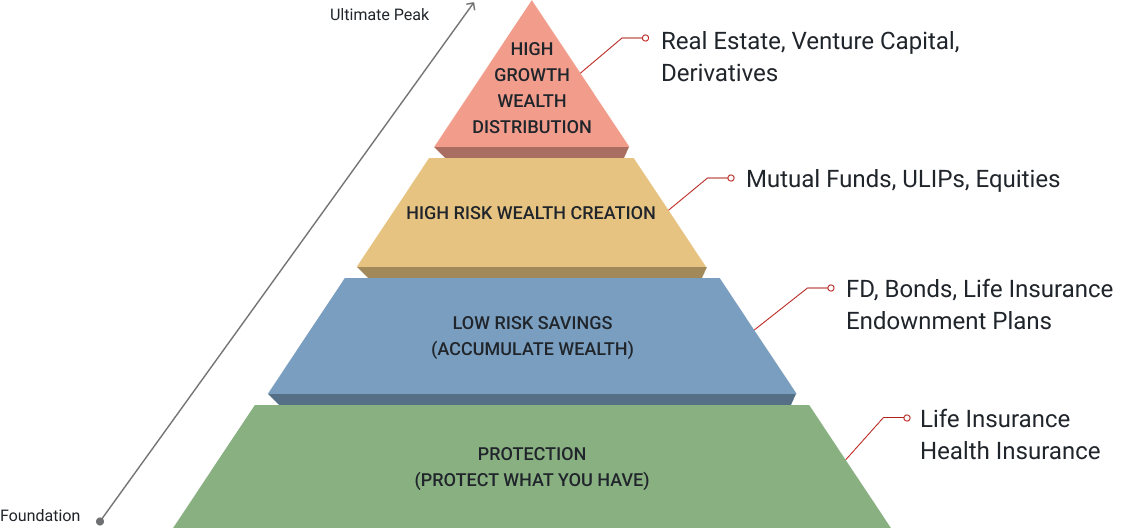

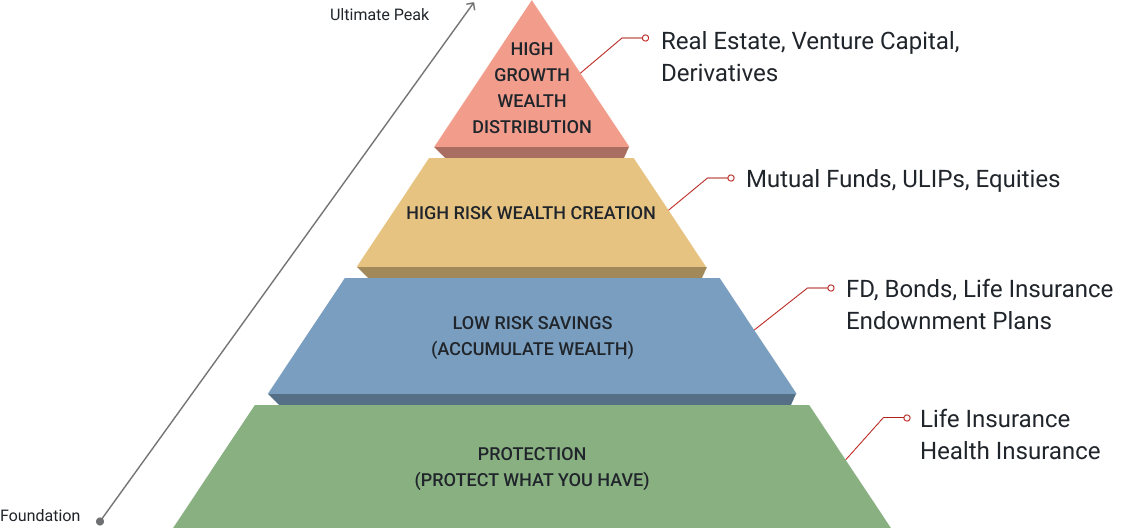

Here’s How to Grow Safely, Smartly and Financially

This pyramid helps you understand how to layer protection, savings and investments the right way.

About Generali Central Life Insurance

Generali is the majority shareholder with a stake of XX% in the company brings 190+ years of insurance expertise as well as its global network’s best practices driving sustainable and profitable growth for its stakeholders. Central Bank of India which holds XX% stake, brings a vast distribution network having 4545 branches across the country, offering a comprehensive range of financial products and services to cater to the diverse needs of its customer. Generali Central India Life Insurance Company has a wide range of life protection and retirement products available through its sales channel of over XXXX financial advisors and banca partners in India.

Trusted Shareholders

We’ve built a strong organisation so you can feel confident in every conversation, every product and every promise.

Central Bank of India is a pioneer in Indian banking and the first commercial bank wholly owned and managed by Indians. Known for its first-of-its-kind initiatives, the Bank has consistently introduced innovative schemes for all sections of society. With a majority presence in rural and semi-urban areas, it remains committed to financial inclusion and empowering India’s unbanked population.

Generali is one of the largest integrated insurance and asset management groups worldwide. Established in 1831, it is present in over 50 countries in the world, with around 87 thousand employees and 165 thousand agents serving 71 million customers (Figures as at December 31, 2024).

How Life Insurance Supports Your Bigger Financial Picture

Life insurance helps you do more than protect your family, it helps you save, plan and grow your money for the future.

Life Stage Planning

Assured Income Benefits

Financial Security

Wealth Creation

Death Benefit

Disciplined Saving

Loan Options

Tax Savings

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central Life Insurance.

We’re Here to Make Financial Planning Feel Easy

Start at your own pace with tools and support designed to help you feel clear and confident about your choices.

Choose a life insurance plan that protects your goals & family.

Talk to our experts and find what fits you best.

Start planning smarter with our easy-to-use financial calculator.

What Our Happy Customers Are Saying

Real stories, real people - hear from those who’ve taken the step towards securing their future with us.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that protects your loved ones in case something happens to you. It provides a lump sum or regular payouts in the event of death or after a set period, depending on the type of policy. Along with protection, Generali Central Life Insurance plans also help you save or invest for major life goals like your child’s education, buying a home, or retirement. It ensures long-term security, peace of mind, and helps you build a financially stable future.

Choosing the right life insurance plans depends on your needs. If you want pure protection, a term plan is ideal. For savings and life cover, consider savings or endowment plans. A life insurance company like Generali Central Life Insurance offers expert guidance to help you pick from various types of life insurance policies and plans that match your financial goals and provide long-term security. Also, you can enjoy the benefits of life insurance such as guaranteed returns, tax savings, and complete peace of mind.

A good rule is to have coverage 10-15 times your annual income. Consider your family's living expenses, loans, and future financial goals like education or homeownership. A life insurance provider like Generali Central Life Insurance, can help assess your needs and recommend the right coverage, supported by life insurance riders to ensure complete protection. When comparing plans, it’s not just about the coverage—it’s also about finding the features and benefits that fit your lifestyle and future needs .

You can start your life insurance journey online with Generali Central Life Insurance by exploring available plans, understanding benefits, and requesting a callback. While policies aren’t purchased online directly, you can compare options, calculate premiums, and get expert help to make an informed decision, all from the comfort of your home.

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central Life Insurance.